Texas Instruments said profit and sales soared in the final quarter of 2020, buoyed by strong demand for analog, power, and other semiconductors used in consumer, industrial, and automotive segments.

The company’s shares have been pressured by concerns around global chip shortages, which have roiled the semiconductor industry in recent months and forced many top auto manufacturers to slow down production to rebuild inventory. Looking ahead, Texas Instruments said it forecasts earnings in the first quarter of 2021 of $1.44 and $1.66 per share on total revenue of $3.79 billion to $4.11 billion.

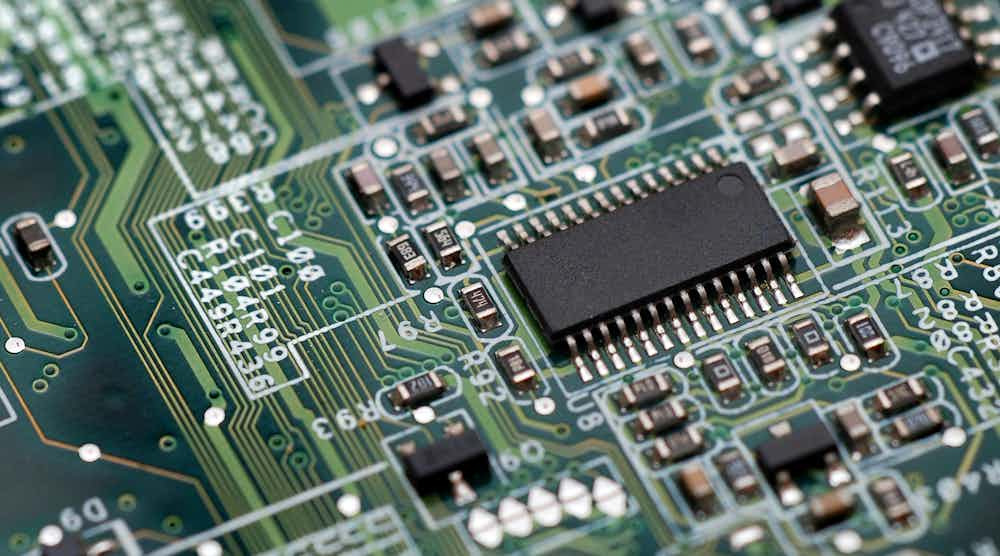

TI, whose quarterly results are considered a barometer for global chip demand, sells 80,000 products, from analog and power management chips to microcontrollers (MCUs) and microprocessors (MPUs) used in cars, on factory floors and in smartphones and other consumer devices. It supplies more than 100,000 customers, making it more diversified than many other players in the semiconductor market.

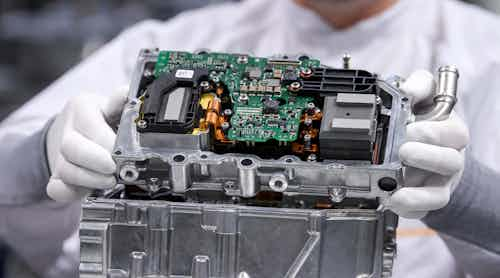

The company's primary markets—industrial systems (37% of its total revenue in 2020), automotive (20% of its overall sales), consumer electronics (27% of its total revenue)—are highly profitable areas that TI’s management believe give it the best opportunities for future growth. TI said sales of analog and other chips used in cars soared 25% year over year in the last quarter as the sector recovered.

The chip industry is grappling with a sharp increase in demand from manufacturers, specifically in the car sector. Last year, global sales of cars slumped as the coronavirus spread around the world, forcing auto manufacturers and vendors to pause any new orders as they went through inventory reserves. But at the end of the year, when sales started to turn around, demand for chips used in cars returned, leading to widespread chip shortages and forcing automakers to idle production.

TI表示,它已经在很大程度上避免了供应欺诈straints reported by semiconductor industry rivals in recent months, which have lead to price increases for a wide range of IC products, analysts say.

Early last year, TIdetailed plainsto maintain production at its fabs at around the same levels as before the novel coronavirus started to shut down large swathes of the global economy. TI said it needed more inventory on hand to meet any snapback in demand as the lockdowns loosened and the spread of the deadly virus slowed. The company said it could afford to build up its inventory because most of its analog, power, embedded, and other IC products have very long shelf lives.

“Our long-term objective for inventory is to maintain high levels of customer service while we minimize inventory obsolescence,” Rafael Lizardi, the company's chief financial officer, said in a conference call with analysts last week. “Our parts are mainly catalog parts that sell into industrial and automotive. Our focus is on those parts with long product lifecycles so we can build inventory ahead of demand."

TI said that, despite some "hot spots" of demand where customers are pressuring its supply chain, it has the the inventory and production capacity in place to fill the orders coming in from customers. The analog chip giant said it is not seeing any severe supply constraints and that its lead times have remain short. Additionally, the widespread shortages have not forced it to raise prices on its products.

One of its major advantages is that it manufactures most of its chips internally instead of relying on contract foundries that make chips designed by other vendors, such as Nvidia, AMD, and Qualcomm. While TSMC and other leading foundries are struggling to keep up with the rebound in demand for automobile chips, TI sources around 80% of its chips—and virtually all its analog semiconductors—internally, and many of its most popular products remain on the market for more than a decade.

TI has also shifted to selling more of its products directly to customers in recent years, instead of going through electronics distributors. That gives it more independence and control over its supply chain.

The company said sales increased to $4.08 billion in the fourth quarter last year from $3.35 billion a year ago—an improvement of more than 20%. On average, industry analysts forecast profits of $1.34 per share and total sales of $3.61 billion. "Sales increased by 7% sequentially, driven by strong demand in automotive, personal electronics and industrial," Chief Executive Rich Templeton said in a statement.

TI reported net income for the fourth quarter of 2020 of $1.69 billion, or $1.80 per share, compared with $1.07 billion, or $1.12 a share, a year ago. The company's gross profit margin came out to 65%.